Stop Guessing.

Start Seeing.

You know the next big trend. But what are the hidden companies powering it? Gainwize gives you the data to discover under-the-radar stocks before they hit the mainstream.

Try monthly for $1 • Cancel anytime

Investing in a Trend Shouldn't Be a Gamble.

You see AI, space exploration, drones, or robotics taking off. So you invest in the one or two big names everyone is talking about, crossing your fingers that you picked the right one. You're buying the wave when it's already peaking, while dozens of crucial, high-growth companies that form the backbone of that trend remain invisible.

Discover the Companies Behind the Trend

Everything you need to uncover hidden investment opportunities before they become mainstream

Find the Hidden Players

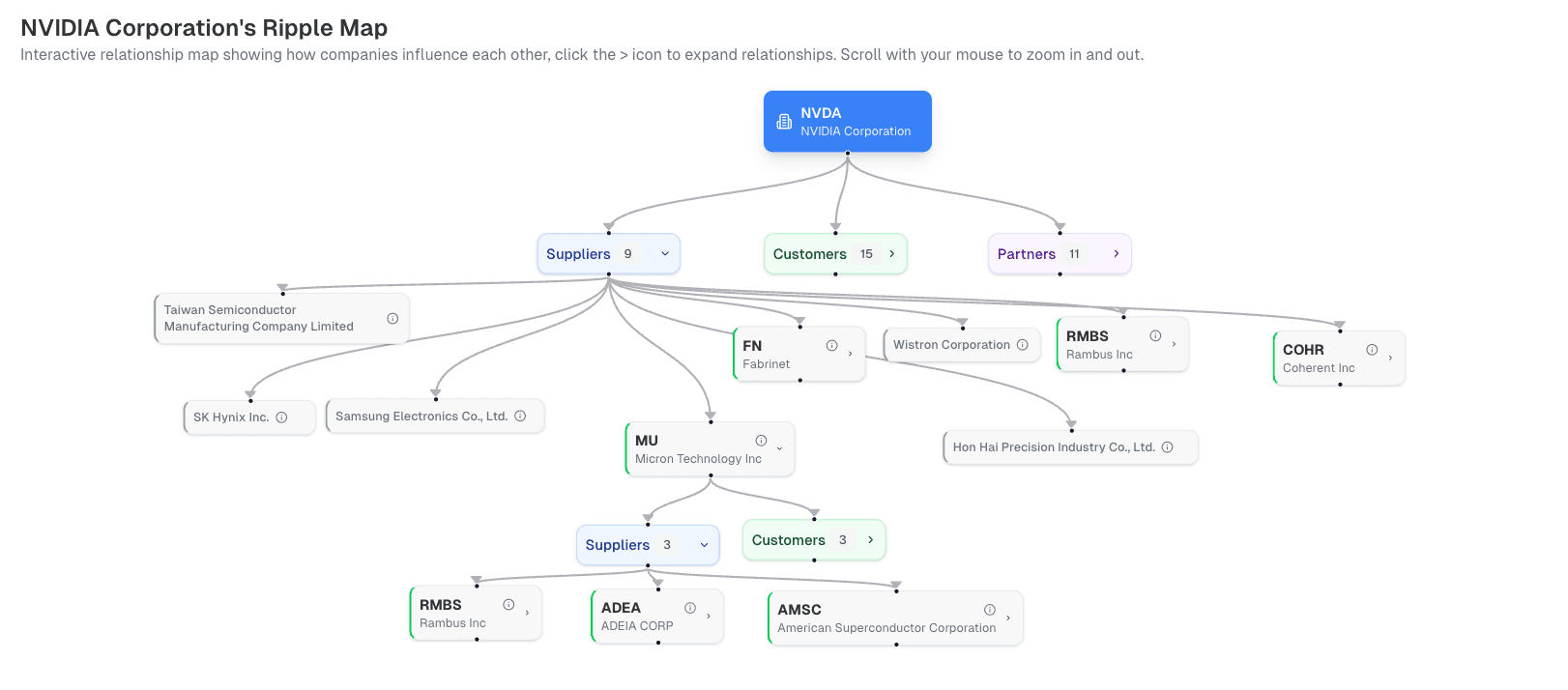

See a company's relationships with others to find hidden opportunities with our Ripple Maps.

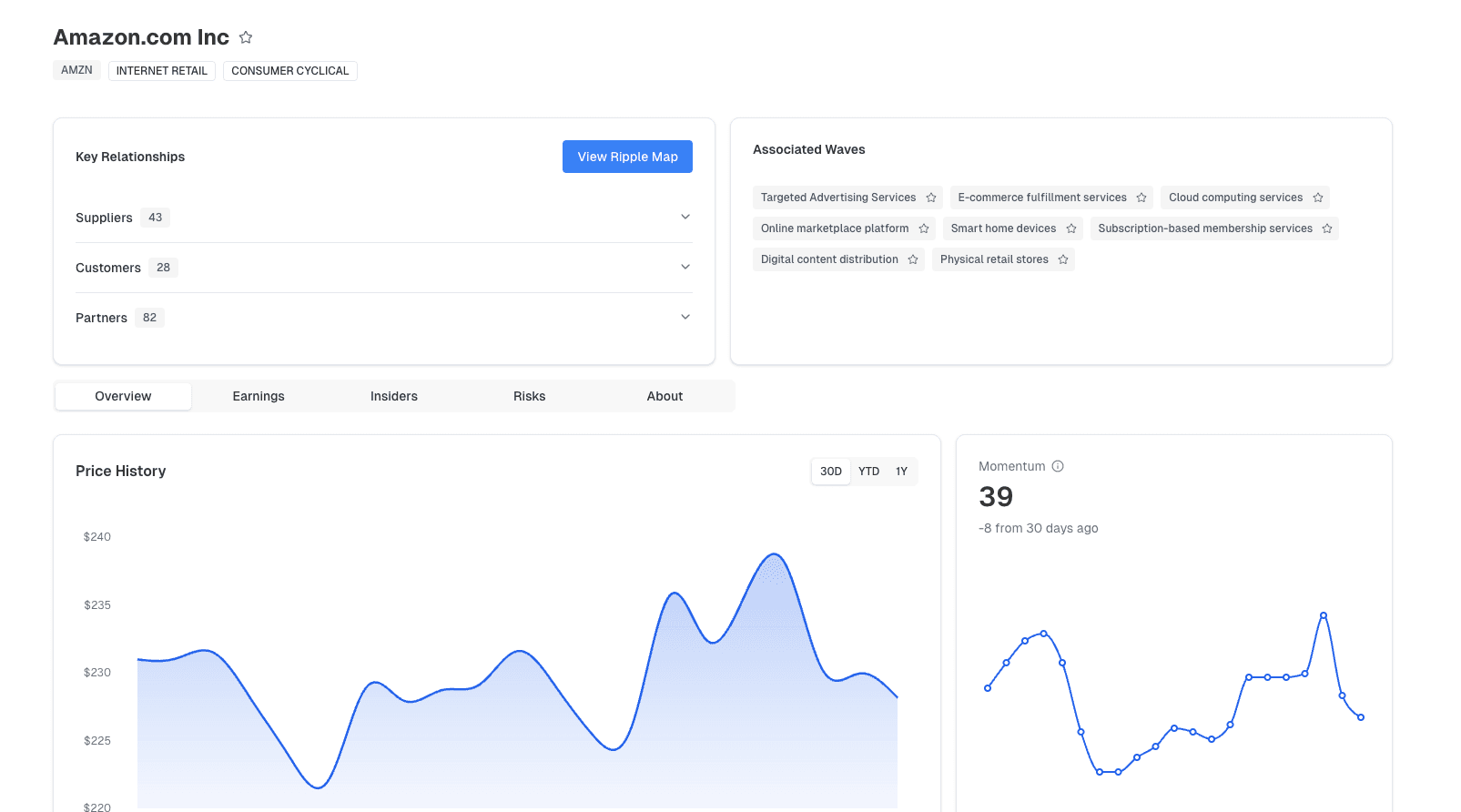

Validate Your Discovery

Get the confidence to act with clear signals from momentum scores and insider data.

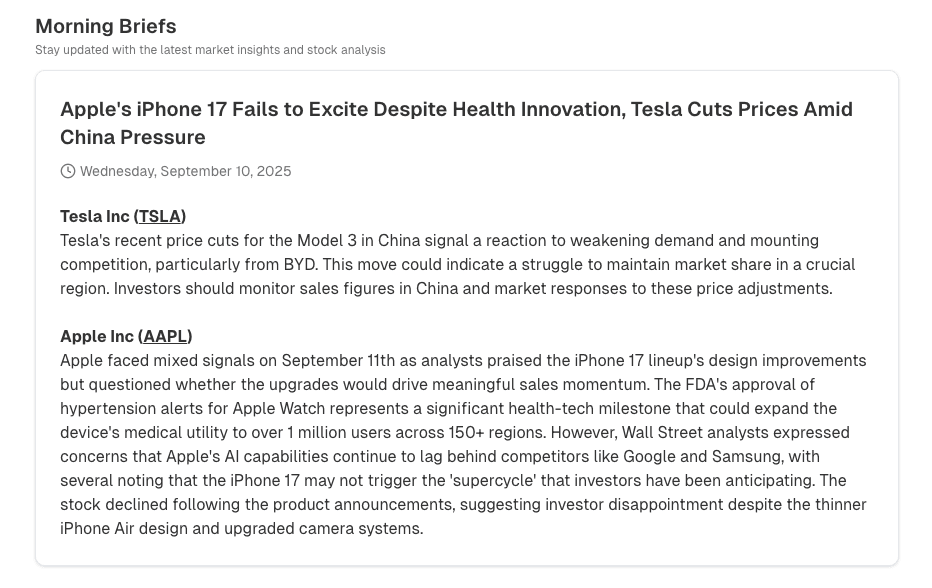

Your Daily Market Edge

Wake up to a personalized pre-market brief with the key insights you need for the day.

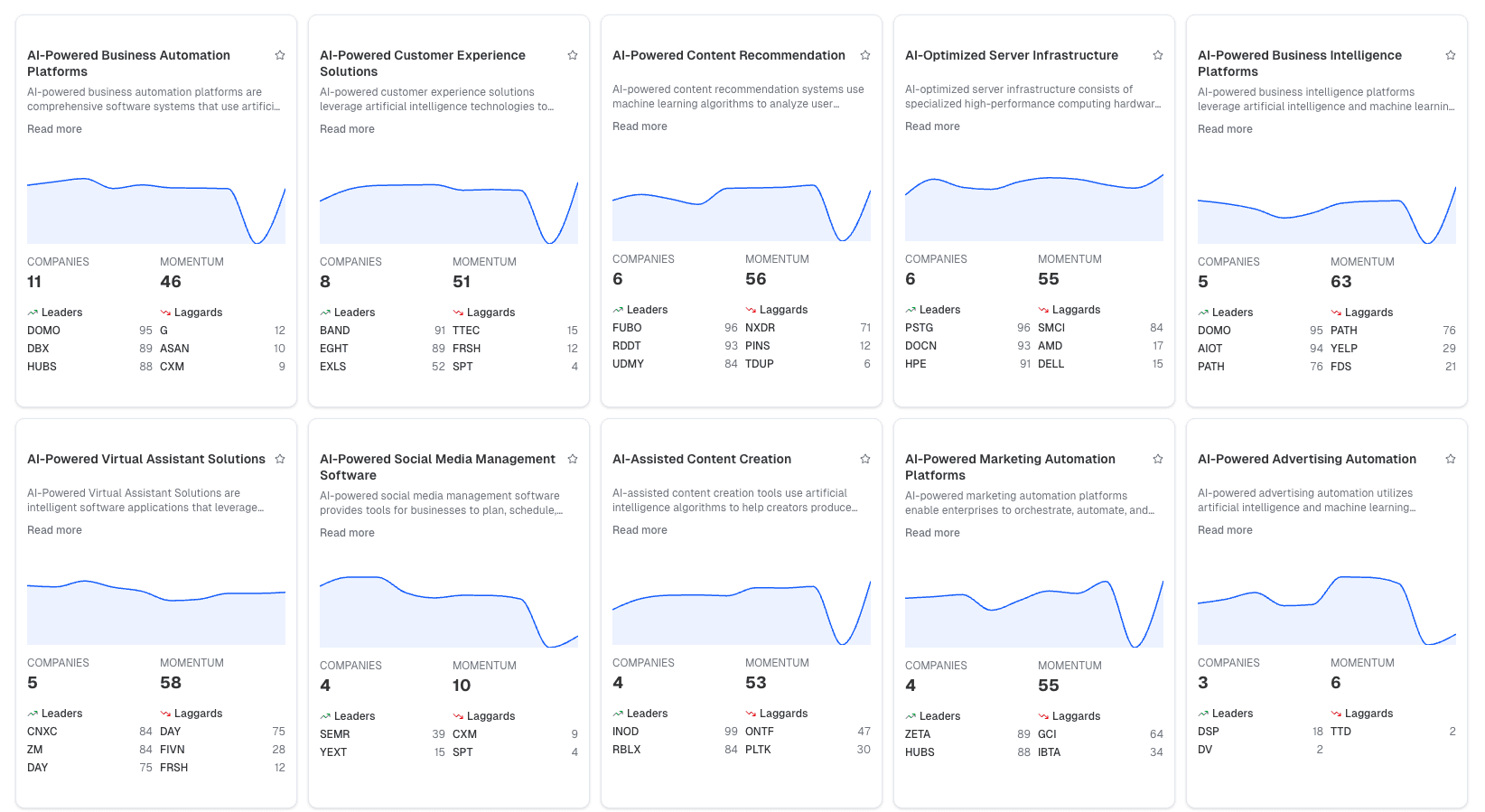

Explore New Waves

Explore our curated "Waves" to discover the next generation of innovators in any field.

Find Your Next Wave of Opportunity

Think of these like expertly curated playlists for investors. Explore trending sectors with hidden gems waiting to be discovered.

Pricing

Try monthly for $1 • Cancel anytime

Frequently Asked Questions

The Market is Full of Hidden Gems. Start Finding Them.

Your 14-day trial gives you unlimited access to the entire Gainwize platform. In the next 10 minutes, you could discover a company that becomes the cornerstone of your portfolio.

No credit card required